Supply and Demand!

I've had this idea rolling around in my head on the economic effects of health insurance coverage mandates. It started in my mind over contraceptives, but could be applied to just about anything, from prescriptions to doctor visits.

My wife had an economics teacher who told her, "If you don't know about supply and demand, you will fail!" You have to understand supply and demand.

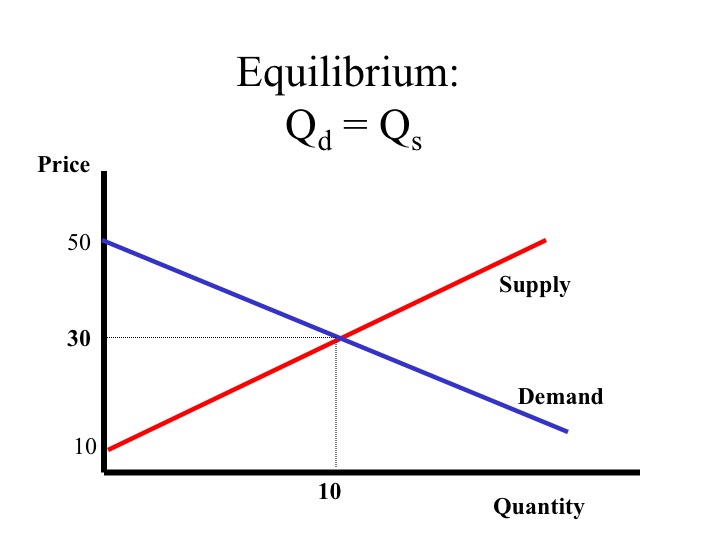

Quick Micro Econ 101 review. Look at the graph over here. If you've taken an econ class, you should have seen variations on this again and again. The blue line shows that as price goes up, the number of people willing to jump in and buy goes down, and vice versa. Red line shows that when price goes up, sellers are more excited about selling. Somewhere in the middle, the quantity of product that buyers want to buy meets up with the quantity that sellers want to sell, and there we have what we call market equilibrium.

That market equilibrium price is what you will pay without insurance in the mix. Using the numbers in the graph, let's say it's a 10 month supply for $30. It's up to you to decide whether you can afford it, or whether you want to look for alternatives. It's that freedom to decide between "that's a bargain, I'll take it!" and "too rich for my blood, I'm going somewhere else" that gives the customer power over prices.

Now, the law comes in, and demands that people should be able to get their three year supply of this product for a $5 copay. What are customers going to start doing? Price goes down, more people will buy.

How do sellers react when the quantity being purchased goes up? They raise the price! Who pays the inflated price? The insurance company! Where do they get the money to cover their increased expenses? They have to raise premiums! And the customer doesn't have the freedom to decide that the increased premium isn't worth it, they have to buy! Now these drug companies get to sell more of their product at an inflated price, all because of a law that was supposed to bring costs down!

In other words, the customer is acting like they are paying a price lower than equilibrium, but in reality they are paying a price which is much higher.

I believe that is what the economists call "unintended consequences".

I'm not saying that insurance is bad. I'm saying that mandates which mess with supply and demand and rob the customer of their power to drive prices down are bad.

Are there any real ways to bring down prices that might use supply and demand, instead of trying to fight them? There are a few. If you want to attack it from the supply side, look for ways of making manufacture less expensive. Maybe figure out if there are some regulations or rules that aren't really helping anyone, that can be taken off the books. Or, see if you can invent a cheaper way of making the same high quality product.

If you want to attack it from the demand side, you could encourage people to be discerning price shoppers. Give them the power to walk away from purchasing decisions. Help them make the distinction between what they are buying because of want and what they really need. This is going to be an individual decision, and "universal" plans and programs are not going to help here.

My wife had an economics teacher who told her, "If you don't know about supply and demand, you will fail!" You have to understand supply and demand.

Quick Micro Econ 101 review. Look at the graph over here. If you've taken an econ class, you should have seen variations on this again and again. The blue line shows that as price goes up, the number of people willing to jump in and buy goes down, and vice versa. Red line shows that when price goes up, sellers are more excited about selling. Somewhere in the middle, the quantity of product that buyers want to buy meets up with the quantity that sellers want to sell, and there we have what we call market equilibrium.

That market equilibrium price is what you will pay without insurance in the mix. Using the numbers in the graph, let's say it's a 10 month supply for $30. It's up to you to decide whether you can afford it, or whether you want to look for alternatives. It's that freedom to decide between "that's a bargain, I'll take it!" and "too rich for my blood, I'm going somewhere else" that gives the customer power over prices.

Now, the law comes in, and demands that people should be able to get their three year supply of this product for a $5 copay. What are customers going to start doing? Price goes down, more people will buy.

How do sellers react when the quantity being purchased goes up? They raise the price! Who pays the inflated price? The insurance company! Where do they get the money to cover their increased expenses? They have to raise premiums! And the customer doesn't have the freedom to decide that the increased premium isn't worth it, they have to buy! Now these drug companies get to sell more of their product at an inflated price, all because of a law that was supposed to bring costs down!

In other words, the customer is acting like they are paying a price lower than equilibrium, but in reality they are paying a price which is much higher.

I believe that is what the economists call "unintended consequences".

I'm not saying that insurance is bad. I'm saying that mandates which mess with supply and demand and rob the customer of their power to drive prices down are bad.

Are there any real ways to bring down prices that might use supply and demand, instead of trying to fight them? There are a few. If you want to attack it from the supply side, look for ways of making manufacture less expensive. Maybe figure out if there are some regulations or rules that aren't really helping anyone, that can be taken off the books. Or, see if you can invent a cheaper way of making the same high quality product.

If you want to attack it from the demand side, you could encourage people to be discerning price shoppers. Give them the power to walk away from purchasing decisions. Help them make the distinction between what they are buying because of want and what they really need. This is going to be an individual decision, and "universal" plans and programs are not going to help here.

Comments

But if, instead, you view health care as a "right", for which the government will guarantee you access, the law of supply and demand does not apply.